(NewsNation) — All eyes are on Venezuelan oil, as President Donald Trump outlines plans to “take back oil assets and land,” following Saturday’s capture of Nicolás Maduro.

A lot of the “stolen” talk coming from the Trump administration dates back more than 50 years. Because it has been so long since there was American oil interest in Venezuela, questions exist around how much of an appetite there is from big oil to return to a nation that is now in turmoil. That is despite Venezuela having one of the largest oil reserves on the planet at more than 300 billion barrels. That’s nearly as much as Canada and Iraq combined.

The problem lies in Venezuela’s aging, ancient infrastructure. While it has a massive oil reserve, Venezuela produces less than a million barrels per day. Meanwhile, Saudi Arabia pushes out 11 million barrels per day, and the U.S. double that. Trump, though, was insistent on Saturday that oil companies will be flocking to Venezuela now that the industry will be under U.S. control.

“We are going to have our very large United States oil companies, the biggest anywhere in the world, go in, spend billions of dollars, fix the badly broken infrastructure, the oil infrastructure, and start making money for the country,” Trump said.

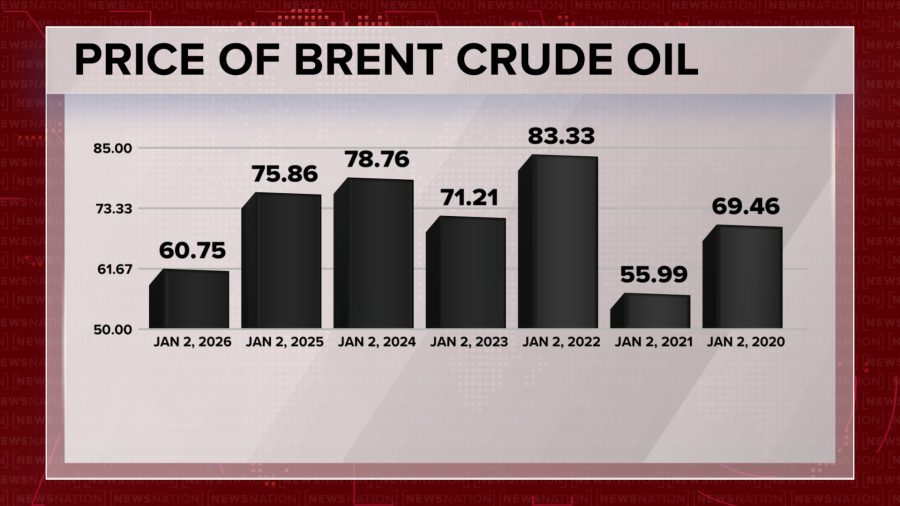

The timing for massive investment, though, is not ideal. Brent Crude prices have not been this low since the pandemic, at least five years. As a result, profit margins are a bit tighter.

Who stands to lose the most from the U.S. taking over Venezuela’s oil production? China, which is around 80% of all Venezuelan oil. Given that the U.S. is in a tariff trade war, Venezuelan oil could potentially provide some leverage.

Oil industry analysts now say that the Trump administration had engaged with oil companies before the strikes. The chair of one consulting firm told the Wall Street Journal that there is already a group of hedge fund and asset managers planning to travel to Venezuela as early as March. As of now, that trip will consist mostly of people from the finance, energy and defense sectors. That planned Wall Street trip will likely include meetings with the new government, the head of Venezuela’s central bank and the stock exchange.

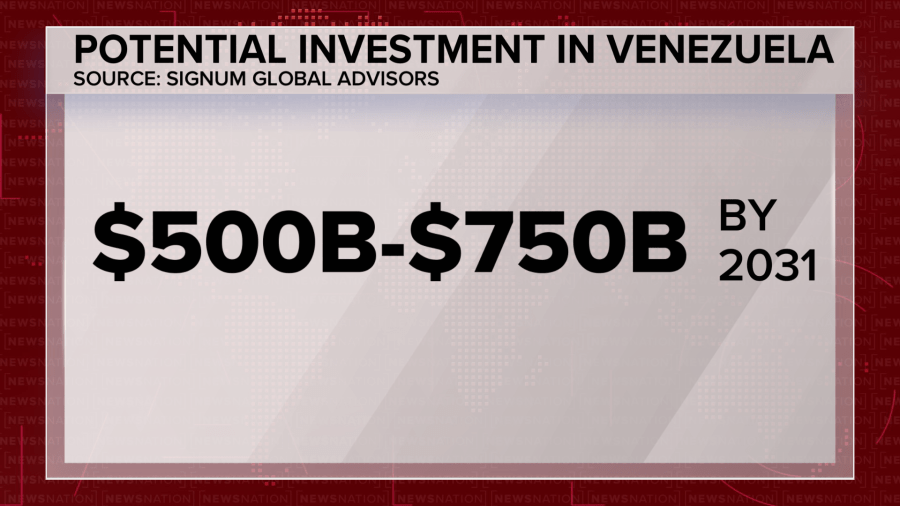

Early estimates place potential investment opportunities in Venezuela between $500 billion and $750 billion over the next five years. All of that is assuming that Venezuela has stable leadership and that the newly created power vacuum is plugged quickly to stabilize the country and avoid civil war.