(NewsNation) — Many Americans are in the process of filing taxes, and some may be wondering what certain tax jargon means.

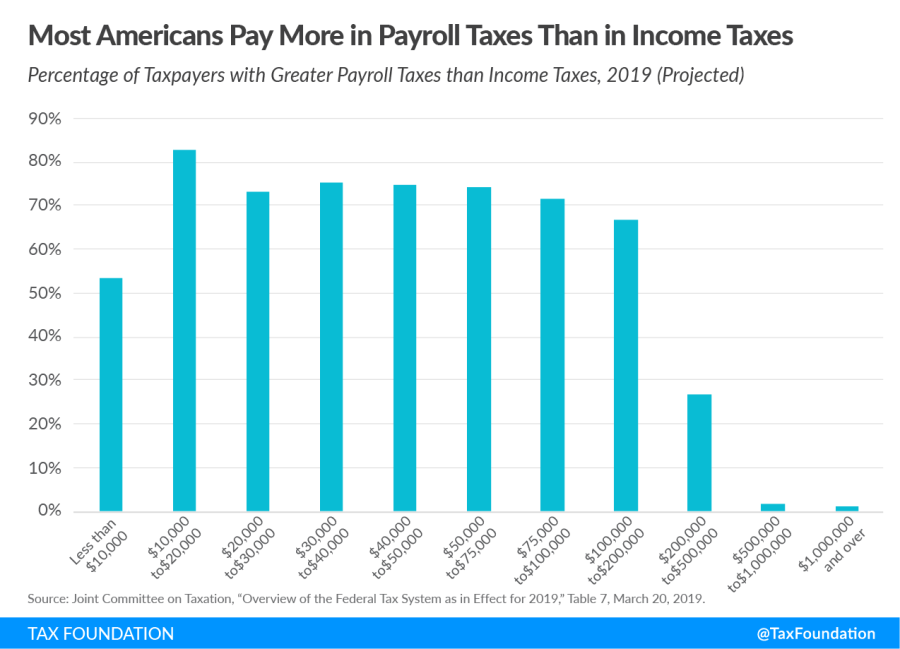

If you’re paying taxes, you should know exactly what you’re paying for. And did you know that most Americans are paying more in payroll taxes than in income taxes?

What is a payroll tax?

A payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance.

Payroll taxes are social insurance taxes that account for 24.8% of total federal, state, and local government revenue, making them the second largest source of that combined tax revenue, the Tax Foundation reports.

Who really pays payroll taxes?

Employees pay almost the entire tax, instead of splitting the burden with their employers.

This is because the tax incidence (who bears the economic burden of a tax) is not determined by law, but by markets, according to the Tax Foundation.